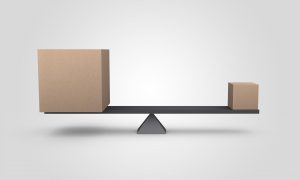

Balancing Danger and Opportunity

By Many would agree that the pandemic times we are living through are unlike any that we have seen in the past. It has quickly forced companies to rethink how they engage with their clients and deliver their products and services. Many industries have seen revenues dramatically shrink and economic indicators predict gloomy days ahead. Collectively we have already decided that we will not be going back to the old ways of business. Too much has changed.

Many would agree that the pandemic times we are living through are unlike any that we have seen in the past. It has quickly forced companies to rethink how they engage with their clients and deliver their products and services. Many industries have seen revenues dramatically shrink and economic indicators predict gloomy days ahead. Collectively we have already decided that we will not be going back to the old ways of business. Too much has changed.

For many, this is a time of crisis. When uncertainty accelerates and new risks emerge there is a tendency to hunker down to protect the organization. This appears to be the case for many organizations. Risk management efforts are being invested in managing risks that threaten organizational value while little attention is being paid to managing risks that may impact growth opportunities.

Yoram (Jerry) Wind [1] reminds us that “In the Kanji characters used in both Chinese and Japanese, the word ‘crisis’ is written with two symbols, the first meaning ‘danger’ and the second ‘opportunity.’”

Losing sight of the dual nature of a crisis and paying too much attention to one side at the expense of the other may threaten the future viability of the company. Balancing ‘danger’ and ‘opportunity’ will be easier for some companies than others. Two ingredients are needed for success; the right perspective and an effective risk management system.

For those companies that have been able to respond to the pandemic disruption and for the most part carry on business as usual they will find themselves responding to new risks from a perspective of strength. Less time will be spent on managing risks that threaten organization value and energy will be available to assess risks that point to new opportunities.

In contrast, organizations that are struggling with business as usual, will likely be preoccupied in managing risks that threaten their existing value. As difficult as it may be, some energy needs to be left to focus on managing risks to growth objectives that will provide a new path to customers and revenue. This requires a shift in perspective; one that is willing to assess risks impacting current revenue objectives and explore possibilities for responding that will increase the value of the organization.

Bringing the right perspective to managing risks will have little impact if your system is flawed. Ideally, your risk management system is designed to manage risks that pose a ‘danger’ to objectives while also allowing a response to risks that present ‘opportunity’.

If your risk management approach does not invest time and effort in assessing risks that signal when growth objectives need to pivot it may be time to change up your risk approach.

After all, the ultimate purpose of a risk management system is to help you make better decisions and increase your chances of success. Now more than ever risk management systems need to deliver.

If yours isn’t doing that, it may be time for a change.

Article Credits:

[1] Wind, Yoram (Jerry), “Ten Guidelines for Creating Opportunities in a Time of Crisis”, April 2020

https://knowledge.wharton.upenn.edu/article/ten-guidelines-create-opportunities-coronavirus-crisis/