Archive for Risk Management

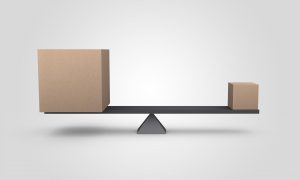

Balancing Danger and Opportunity

Posted by: | Comments Many would agree that the pandemic times we are living through are unlike any that we have seen in the past. It has quickly forced companies to rethink how they engage with their clients and deliver their products and services. Many industries have seen revenues dramatically shrink and economic indicators predict gloomy days ahead. Collectively we have already decided that we will not be going back to the old ways of business. Too much has changed.

Many would agree that the pandemic times we are living through are unlike any that we have seen in the past. It has quickly forced companies to rethink how they engage with their clients and deliver their products and services. Many industries have seen revenues dramatically shrink and economic indicators predict gloomy days ahead. Collectively we have already decided that we will not be going back to the old ways of business. Too much has changed.

For many, this is a time of crisis. When uncertainty accelerates and new risks emerge there is a tendency to hunker down to protect the organization. This appears to be the case for many organizations. Risk management efforts are being invested in managing risks that threaten organizational value while little attention is being paid to managing risks that may impact growth opportunities.

Yoram (Jerry) Wind [1] reminds us that “In the Kanji characters used in both Chinese and Japanese, the word ‘crisis’ is written with two symbols, the first meaning ‘danger’ and the second ‘opportunity.’”

Losing sight of the dual nature of a crisis and paying too much attention to one side at the expense of the other may threaten the future viability of the company. Balancing ‘danger’ and ‘opportunity’ will be easier for some companies than others. Two ingredients are needed for success; the right perspective and an effective risk management system.

For those companies that have been able to respond to the pandemic disruption and for the most part carry on business as usual they will find themselves responding to new risks from a perspective of strength. Less time will be spent on managing risks that threaten organization value and energy will be available to assess risks that point to new opportunities.

In contrast, organizations that are struggling with business as usual, will likely be preoccupied in managing risks that threaten their existing value. As difficult as it may be, some energy needs to be left to focus on managing risks to growth objectives that will provide a new path to customers and revenue. This requires a shift in perspective; one that is willing to assess risks impacting current revenue objectives and explore possibilities for responding that will increase the value of the organization.

Bringing the right perspective to managing risks will have little impact if your system is flawed. Ideally, your risk management system is designed to manage risks that pose a ‘danger’ to objectives while also allowing a response to risks that present ‘opportunity’.

If your risk management approach does not invest time and effort in assessing risks that signal when growth objectives need to pivot it may be time to change up your risk approach.

After all, the ultimate purpose of a risk management system is to help you make better decisions and increase your chances of success. Now more than ever risk management systems need to deliver.

If yours isn’t doing that, it may be time for a change.

Article Credits:

[1] Wind, Yoram (Jerry), “Ten Guidelines for Creating Opportunities in a Time of Crisis”, April 2020

https://knowledge.wharton.upenn.edu/article/ten-guidelines-create-opportunities-coronavirus-crisis/

Risk Management In Times of Uncertainty

Posted by: | CommentsYou may remember hearing about the successful landing of US Air Flight 1549 in the Hudson River on January 15, 2009. Thankfully everyone walked away from the “miracle on the Hudson”.

Despite the passage of time this event provides a valuable lesson in risk management that is important today as we deal with the COVID -19 pandemic. In our rush to respond to the crisis, we cannot forget the basics.

Effective risk management demands that we keep our objectives front and centre while identifying and assessing the risks and determining action that will helps us achieve our goal.

In responding to the COVID-19 pandemic, now more than ever it is important to not lose sight of our objectives and the priority of those objectives.

Captain Chesley “Sully” Sullenberger and his co pilot Jeffrey Skiles never lost sight of their objective to preserve as many lives as possible while assessing the risks and determining a course of action; all in the space of about 3 minutes.

The plane took off at 3:24 and Captain Sully called out “birds” at 3:27. At 3:30 the plane landed on the Hudson and at 3:32 everyone was out of the plane.

From the time the pilot called out “birds” to landing on the Hudson, Captain Sully and his crew had to decide if they could get back to LaGuardia. Returning to LaGuardia would have meant crossing over the city of Manhattan and putting people on the ground at risk. If the plane crashed with full fuel tanks the plane and everything around it would be incinerated. Another option was to try and make it to the Teterboro Airport that was closer but still required flying over a populated area. Lastly, should the crew try to land on the Hudson? Of course we know the plane successfully landed on the Hudson and everyone survived.

This is what risk management is all about. On your way to your destination, a number of obstacles can get in the way and you need to respond in order to get back on track so that you ultimately reach your destination.

The changing impact of COVID 19 is exerting time constraints and demanding that we continually re assess our options and make decisions. We need to quickly identify and assess the risks, despite not having all the information we would like, and decide very quickly the best path forward to ensure that we ultimately reach our destination. Using the Objective Centric Risk Management approach keeps objectives front and centre.

The changing impact of COVID 19 is exerting time constraints and demanding that we continually re assess our options and make decisions. We need to quickly identify and assess the risks, despite not having all the information we would like, and decide very quickly the best path forward to ensure that we ultimately reach our destination. Using the Objective Centric Risk Management approach keeps objectives front and centre.

If you haven’t tried this approach maybe the time is now. In these uncertain times when everything we’ve known has turned upside down and we are seeking better ways to achieve our goals, perhaps now is the time to embrace the Objective Centric Risk Management approach.

The best source for Objective Centric Risk Management is Tim Leech. His site is Risk Oversight Solutions.com

During these uncertain times we are all stronger together as a community. If you have any questions, comments or insights to share, feel free to email me to abyrnecma at rogers.com